San Diego, California, June 29, 2023 — Mitek Systems, Inc. (NASDAQ: MITK, www.miteksystems.com, “Mitek” or the “Company”), a global leader in digital identity and digital fraud prevention, today reported financial results for both its fourth quarter and fiscal 2022 full year ended September 30, 2022. Total revenue for the full year fiscal 2022 increased 20% year over year, driven by additional revenue as a result of the acquisition of HooYu Ltd. (“HooYu”), as well as increased demand for both Mitek’s digital identity verification and deposits solutions, as commerce continues its rapid shift to digital channels.

Fiscal 2022 Business Accomplishments

- Continued deposits business growth driven by increasing consumer usage of Mobile Check Deposit and strong adoption of Check Fraud Defender by several leading financial institutions.

- Successful integration of HooYu into the Mitek Identity line of business which streamlined operations and yielded significant synergies in product development and go to market.

- Launched the integrated identity platform, Mitek’s Verified Identity Platform (MiVIP), which expanded Mitek’s addressable market and delivered improved unit economics.

- Shortly following the close of the fiscal 2022, Mitek launched MiPass, the industry’s first multi-model biometric solution for continuous identity authentication, which further expanded Mitek’s total addressable market.

Fiscal 2022 Full Year Financial Highlights

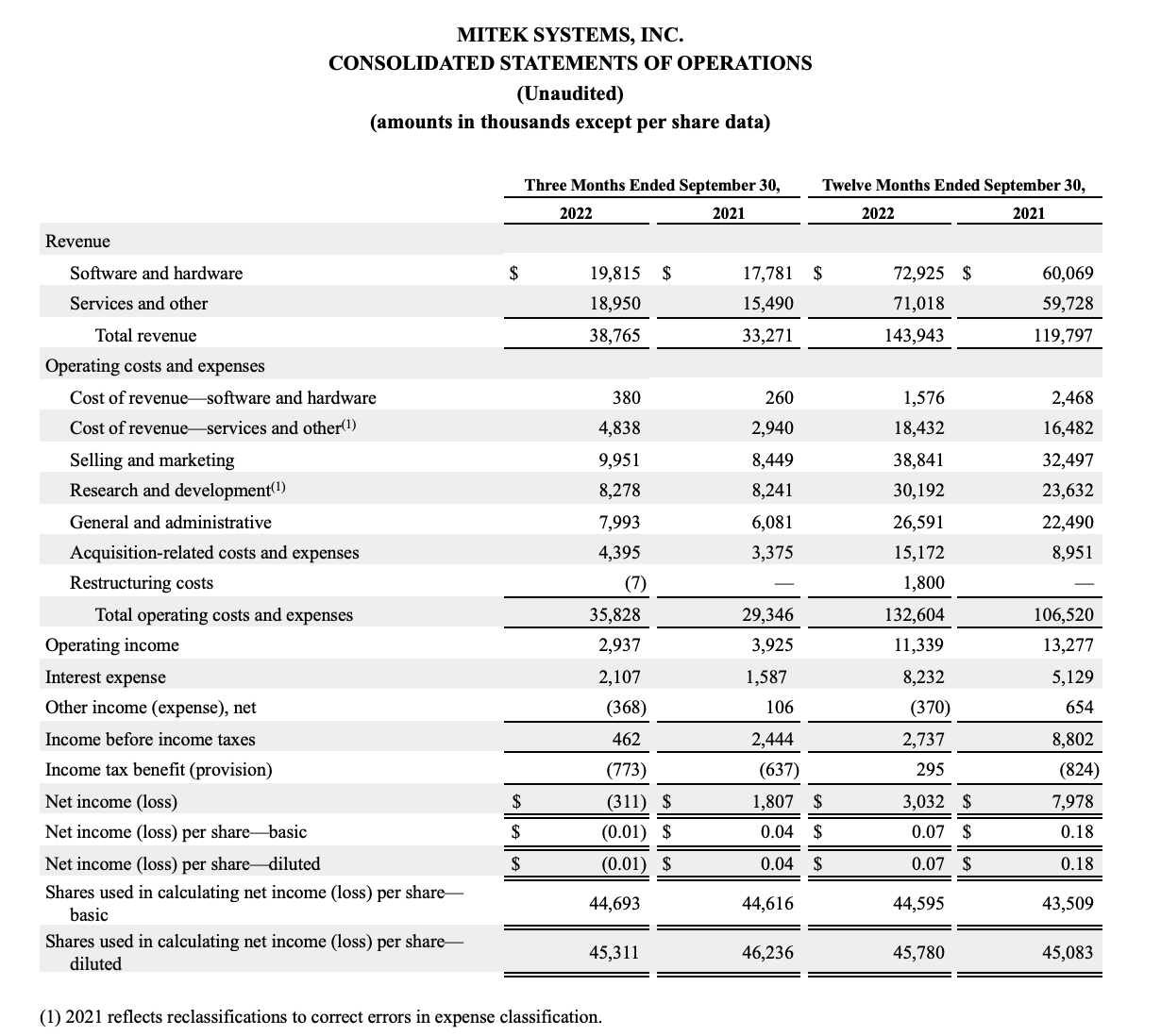

- Total revenue increased 20% year over year to a record $143.9 million.

- GAAP net operating income was $11.3 million.

- GAAP net income was $3.0 million, or $0.07 per diluted share.

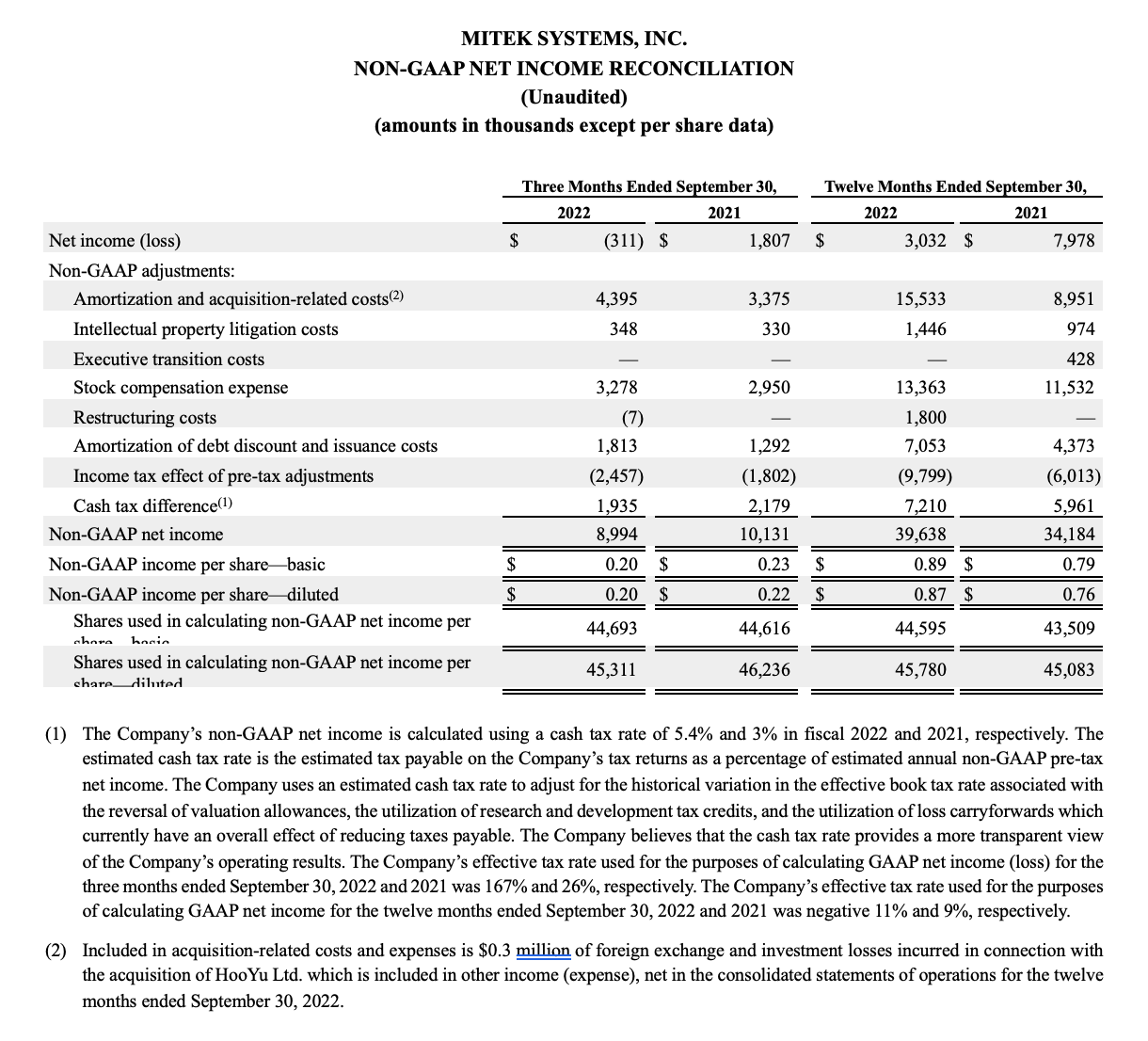

- Non-GAAP net operating income was $43.5 million, operating margin of 30%, up 86 basis points year over year.

- Non-GAAP net income increased 16% year over year to a record $39.6 million, or $0.87 per diluted share.

- Cash flow from operations was $26.4 million.

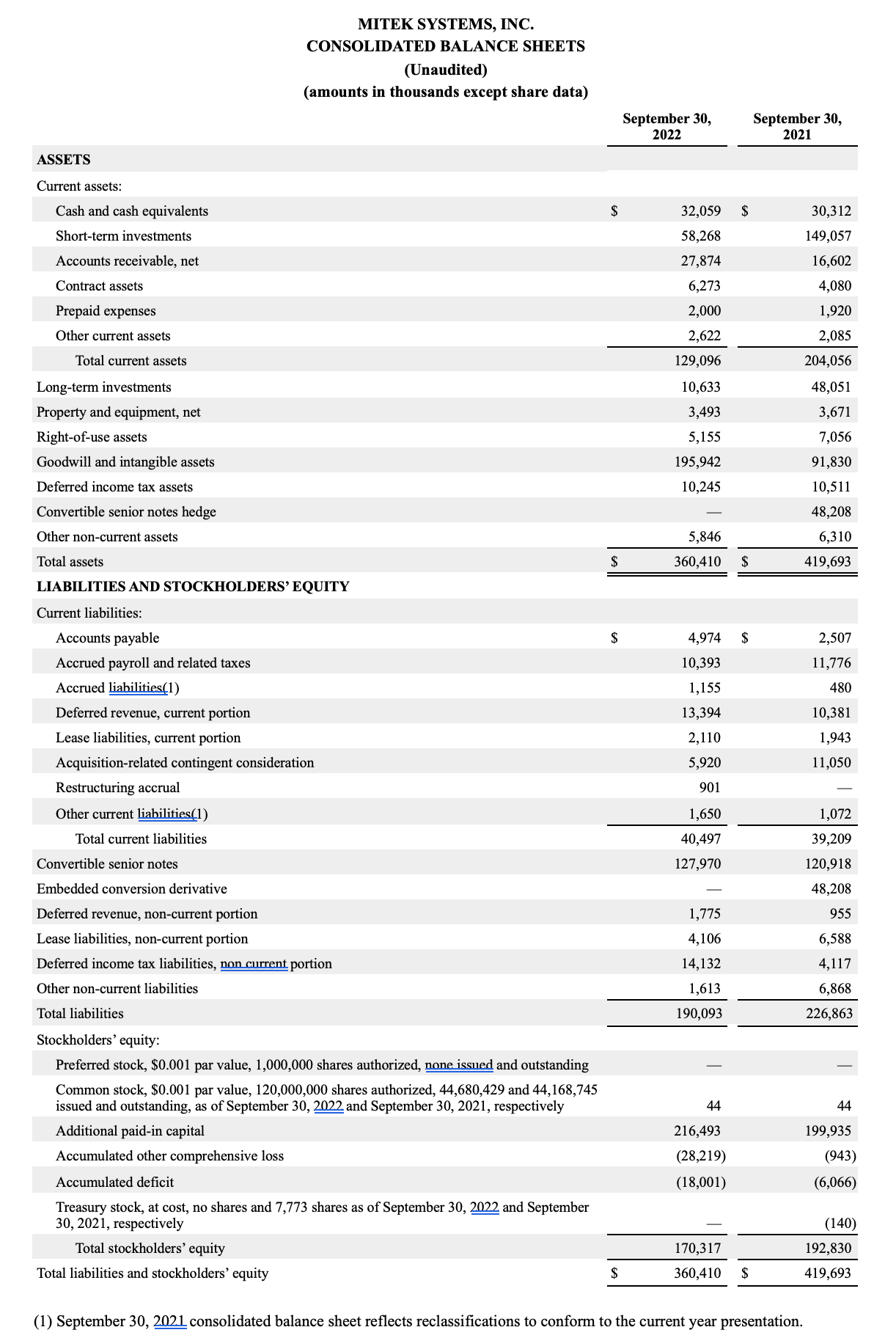

- Total cash and investments were $101.0 million at September 30, 2022.

Fiscal Fourth Quarter 2022 Financial Highlights

- Total revenue increased 17% year over year to $38.8 million.

- GAAP net operating income was $2.9 million.

- GAAP net loss was $0.3 million, or $0.01 per diluted share.

- Non-GAAP net operating income was $11.0 million, operating margin of 28%.

- Non-GAAP net income was $9.0 million, or $0.20 per diluted share.

Mitek CEO, Max Carnecchia’s Comments

“Fiscal 2022 was another record year for Mitek. We again achieved record revenue and earnings and delivered strong cash flow from operations, as we continued to deliver industry leading products that make digital commerce faster and safer. This ongoing momentum reinforces our unwavering optimism about our long-term prospects and our ability to further penetrate our large target addressable markets.”

Fiscal 2023 Guidance

Mitek expects revenue for the year ending September 30, 2023 to be in the range of $162.0 million to $165.0 million, an increase of approximately 14% year over year from the mid-point of the guidance range. In addition, Mitek expects its non-GAAP operating margin for fiscal 2023 to be in the range of 29.5% to 30.5%.

Conference Call Information

Mitek management will host a conference call and live webcast for analysts and investors today at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) to discuss the Company’s financial results. To access the live call, dial 877-270-2148 (US and Canada) or +1 412-902-6510 (International) and ask to join the Mitek call.

A live and archived webcast of the conference call will be accessible on the Investor Relations section of the Company’s website at www.miteksystems.com. In addition, a phone replay will be available approximately two hours following the end of the call, and it will remain available for one week. The phone call replay can be access by dialing 877-344-7529 (US or Canada) or 1-412-317-0088 (International) and entering the passcode: 9370119.

About Mitek Systems, Inc.

Mitek (NASDAQ: MITK) is a global leader in digital identity and digital fraud prevention, with technology to bridge the physical and digital worlds. Mitek’s advanced identity verification technologies and global platform make digital access faster and more secure than ever, providing companies new levels of control, deployment ease and operation, while protecting the entire customer journey. More than 7,800 organizations use Mitek to enable trust and convenience for mobile check deposit, new account opening and more. Learn more at www.miteksystems.com.

Follow Mitek on LinkedIn, Twitter and YouTube, and read Mitek’s latest blog posts here.

Notice Regarding Forward-Looking Statements

Statements contained in this news release relating to the Company or its management’s intentions, hopes, beliefs, expectations or predictions of the future, including, but not limited to, statements relating to the Company’s long-term prospects and market opportunities are forward-looking statements. Such forward-looking statements are subject to a number of risks and uncertainties, including, but not limited to, risks related to the Company’s ability to withstand negative conditions in the global economy, a lack of demand for or market acceptance of the Company’s products, the impact of the Company’s acquisition of HooYu Ltd. including any operational or cultural difficulties associated with the integration of the businesses of Mitek and HooYu Ltd., the Company’s ability to continue to develop, produce and introduce innovative new products in a timely manner, the Company’s ability to capitalize on a growing market, quarterly variations in revenue, the profitability of certain sectors of the Company, the performance of the Company’s growth initiatives, the outcome of any pending or threatened litigation, and the timing of the implementation and launch of the Company’s products by the Company’s signed customers.

Additional risks and uncertainties faced by the Company are contained from time to time in the Company’s filings with the U.S. Securities and Exchange Commission (SEC), including, but not limited to, the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2021, as filed with the SEC on December 13, 2021 and its quarterly reports on Form 10-Q and current reports on Form 8-K, which you may obtain for free on the SEC’s website at www.sec.gov. Collectively, these risks and uncertainties could cause the Company’s actual results to differ materially from those projected in its forward-looking statements and you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company disclaims any intention or obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Investor Contact:

Todd Kehrli or Jim Byers

MKR Investor Relations, Inc.

mitk@mkr-group.com

Note Regarding Use of Non-GAAP Financial Measures

This news release contains non-U.S. generally accepted accounting principles (“GAAP”) financial measures for non-GAAP net income and non-GAAP net income per share that exclude amortization and acquisition-related costs, intellectual property litigation costs, executive transition costs, stock compensation expenses, restructuring costs, amortization of debt discount and issuance costs, income tax effect of pre-tax adjustments, and the cash tax difference. These financial measures are not calculated in accordance with GAAP and are not based on any comprehensive set of accounting rules or principles. In evaluating the Company’s performance, management uses certain non-GAAP financial measures to supplement financial statements prepared under GAAP. Management believes these non-GAAP financial measures provide a useful measure of the Company’s operating results, a meaningful comparison with historical results and with the results of other companies, and insight into the Company’s ongoing operating performance. Further, management and the Board of Directors of the Company utilize these non-GAAP financial measures to gain a better understanding of the Company’s comparative operating performance from period-to-period and as a basis for planning and forecasting future periods. Management believes these non-GAAP financial measures, when read in conjunction with the Company’s GAAP financial statements, are useful to investors because they provide a basis for meaningful period-to-period comparisons of the Company’s ongoing operating results, including results of operations against investor and analyst financial models, which helps identify trends in the Company’s underlying business and provides a better understanding of how management plans and measures the Company’s underlying business.