Check fraud is rapidly increasing.

Enhancing check fraud detection through real-time capabilities, a collaborative consortium, and compromised fraud data signals.

Strengthen fraud defense through a secure, cloud- hosted consortium.

Mitek’s secure, cross-institutional data consortium is a collaborative network with coverage of over 95% of U.S. financial institutions that share critical fraud intelligence. When check fraud is detected, that information is added to this shared network, creating a collective source of truth that grows stronger as more banks adopt the technology.

- Eliminate cross-bank fraud tactics

- Improve back-office check scoring

- Enable real-time fraud decisioning

The only real-time and data-based consortium.

Reduce review times by over 50% with MiControl.

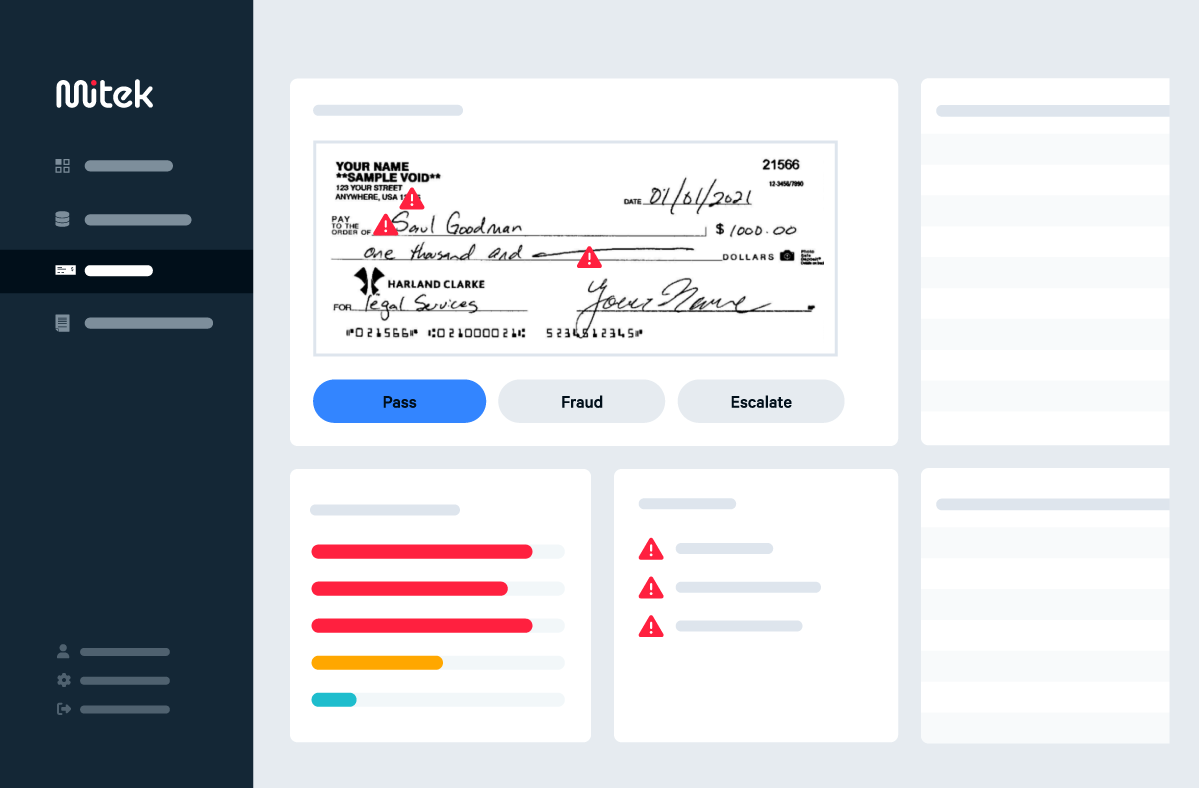

As part of Mitek’s Check Fraud Defender platform, the MiControl Fraud Management Console improves back-office efficiencies with a comprehensive dashboard featuring proprietary visualizations to quickly detect, analyze, and stop incoming check fraud.

With adaptive real-time business rules, actionable insights, and clear visual overlays, MiControl supports day zero analysis and decisioning of fraud suspects. And its intuitive user interface makes single and multi-item reviews, escalations, and queue management a snap.

MiControl delivers an easy-to-use interface that can decrease the time it takes for a fraud analyst to review and make a decision about a suspect check.

WHY FINANCIAL INSTITUTIONS TRUST CHECK FRAUD DEFENDER

Hear more about the rise of check fraud and the power of AI.

Check fraud is rapidly increasing. You need a real-time solution that utilizes advanced machine learning and AI to meet evolving threats.

Thought leadership from identity verification experts

FREQUENTLY ASKED QUESTIONS