Financial SERVICES

Drive a smooth onboarding journey and eliminate fraudsters with digital identity verification

Gain your customers’ trust, stop fraud, and lower abandonment rates while providing fast and seamless digital experiences and journeys.

Verify a user's identity in seconds, naturally and more easily at every touch point

Use identity verification as a growth engine to help you fight fraud, rapidly expand into new geographic markets, increase onboarding and safely reach deeper into existing markets to approve customers you might otherwise decline.

Trust precedes transactions.

Developing and maintaining consumer trust requires creating humancentric experiences backed by a secure and simple solution

Identity verification is essential for every customer and every journey.

Ensure regulatory compliance at all times

Meet any risk profile on your KYC workflows with the identity services you need.

Stay ahead of fraudsters

Better detect attempted impersonation fraud across any customer touchpoint.

Optimize user journeys

Maximize onboarding success rates with minimal friction.

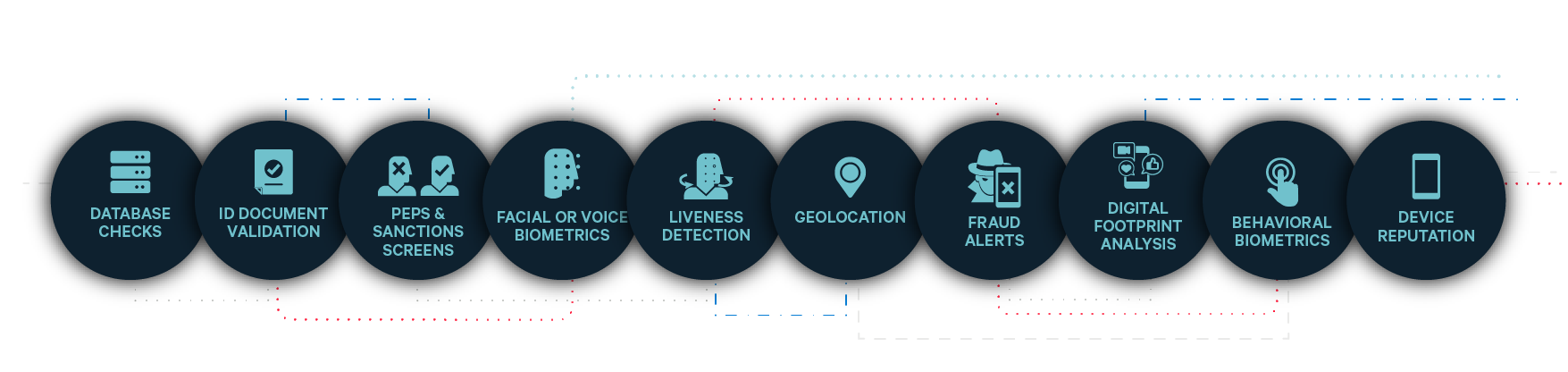

Strengthen trust and convenience using multiple layers of verification signals

Achieve a dynamic, risk-based approach to verifying digital identities by layering identity signals in real time. Customize the identity verification requirements of each journey to create the perfect balance between fraud prevention and the optimal customer experience. Identity verification exactly the way you need it.

Identity solutions for financial services

“Our smart digital tools put our customers in control and the journey helps our customers to successfully pass KYC where traditional name and address checks fail.”

LINDA ROBERTSON

Head of Digital Customer Experience at Virgin Money