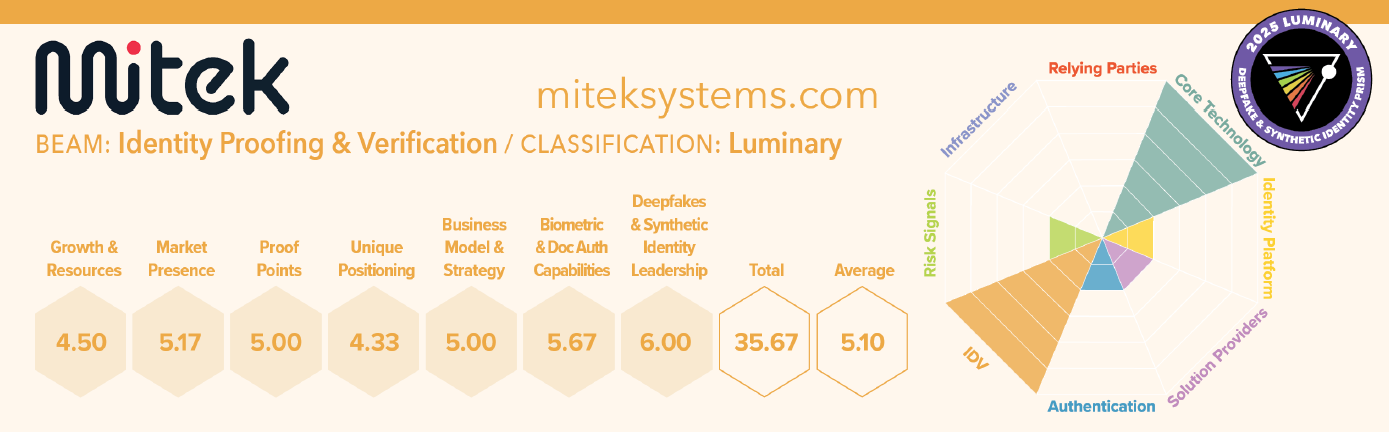

2025 Prism report: Mitek Prism Project Report Status and Profile

An established market force in the document and personally identifiable information (PII) side of identity verification and fraud prevention, Mitek gave itself a biometric upgrade when it acquired ID R&D in 2021 and HooYu the year after. Dedicated to innovation, collaboration, and customer experience, Mitek operates primarily in Europe and North America, where strategic partnerships with the likes of Experian, Equifax, and Ping Identity expand its reach in the financial services, gaming, telecom, and marketplace sectors. Its Digital Fraud Defender suite takes a layered approach to preventing deepfake and injection attacks, and protects users for the full identity lifecycle, which begins when Mitek establishes foundational identity by linking biometrics to government-attested PII during enrollment.

Brick and Mortar Synthetics

As a Synthetic Identity and Deepfake Prism Luminary, Mitek stands out with its novel and forward-thinking applications beyond the common remote verification and authentication use cases. Serving the retail and in-branch banking sectors, the company is bringing the Al-fraud conflict into the physical world, where fraudsters are enrolling synthetic identities in-person by presenting counterfeit PII. As highlighted in this report, synthetic identities are a fraud threat in both physical and digital channels, and the in-person enrollment is an extension of the manual workflow. By equipping human reviewers with the Al-powered tools to verify identity elements face-to-face, Mitek helps defend this vulnerability in the identity perimeter.

Banking Without Deepfakes

UK banking giant NatWest replaced its legacy identity verification system-a multistep process that took days to complete and involved visiting physical branches-with a real-time digital account opening process in 2019. That move, while vastly improving the customer experience, naturally opened up the possibility of fraud. NatWest understands the impact of this, having found through survey data that its customers fear financial fraud more than burglary. Thankfully, working with Mitek allowed NatWest to combine a wide range of identity verification technologies to detect the liveness of biometrics and the authenticity of PII, including contextual identity elements, resulting in a decrease in fraudulent applications.

Defending Every Channel

Digital-first bank Virgin Money integrated Mitek's digital identity checks for similar reasons. As the tide of digital transformation rises, customer expectations are becoming convenience-focused, so manual identity checks at physical branches become a significant drawback in the competitive banking space. With the aim of reducing its physical footprint and satisfying the preferences of its 6.4 million UK customers, Virgin Money incorporated facial recognition, ID document validation, liveness detection, and contingencies for contextual PII like geolocation in order to make sure going digital didn't welcome bad actors into their system via deepfake driven account takeover or synthetic identity fraud.

Download the complete 2025 Prism Report here Download Mitek's Prism Report (PDF)