SAN DIEGO, CA, April 28, 2022 - Mitek (NASDAQ: MITK, www.miteksystems.com), “Mitek” or the “Company”), a global leader in digital identity (ID) and fraud prevention solutions, today reported financial results for its second quarter of fiscal 2022 ended March 31, 2022. Total revenue increased 21% year over year as commerce continues its rapid shift to digital channels.

Mitek capped the quarter with the March acquisition of HooYu, the United Kingdom’s leading Know Your Customer (KYC) technology pioneer. The acquisition allows Mitek to offer customers a powerful end-to-end, easy-to-use platform capable of managing the entire customer identity journey, including account opening, workflow, case management, analytics and re-verification/authentication.

Fiscal second quarter 2022 financial highlights

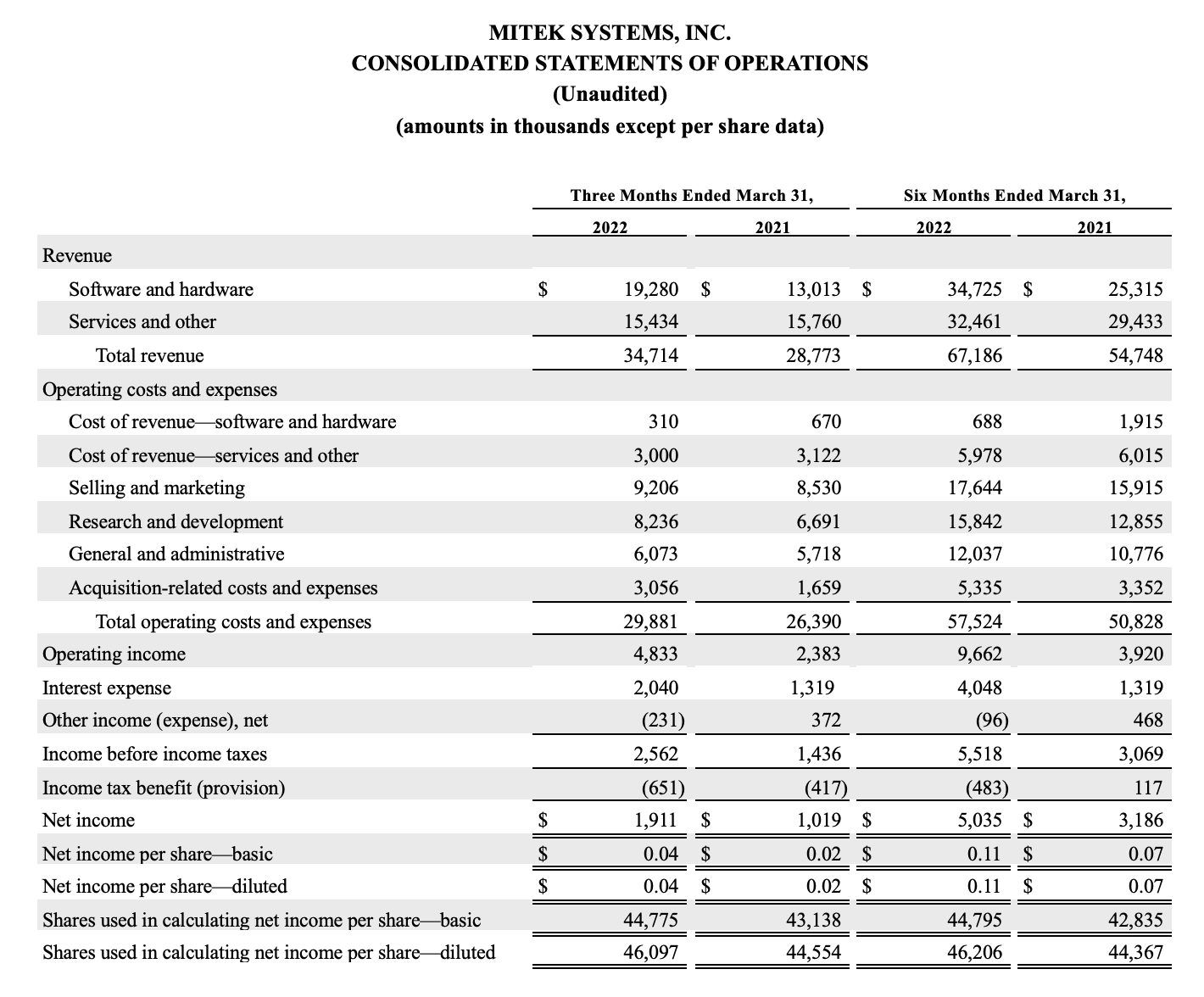

- Total revenue increased 21% year over year to $34.7 million in a record second quarter.

- GAAP net income increased 88% year over year to $1.9 million, or $0.04 per diluted share.

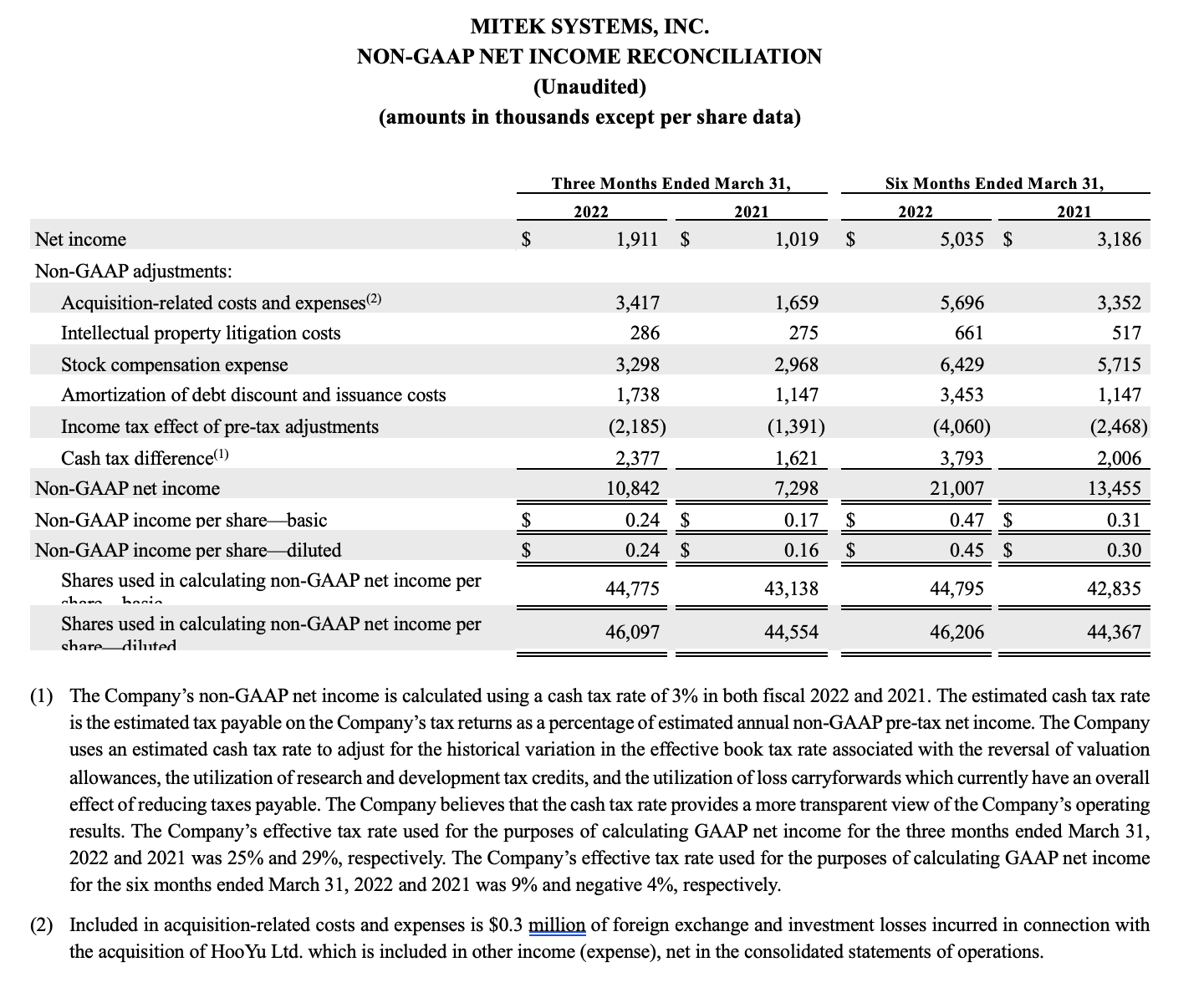

- Non-GAAP net income increased 49% year over year to $10.8 million, or $0.24 per diluted share.

- Cash flow from operations was $7.4 million.

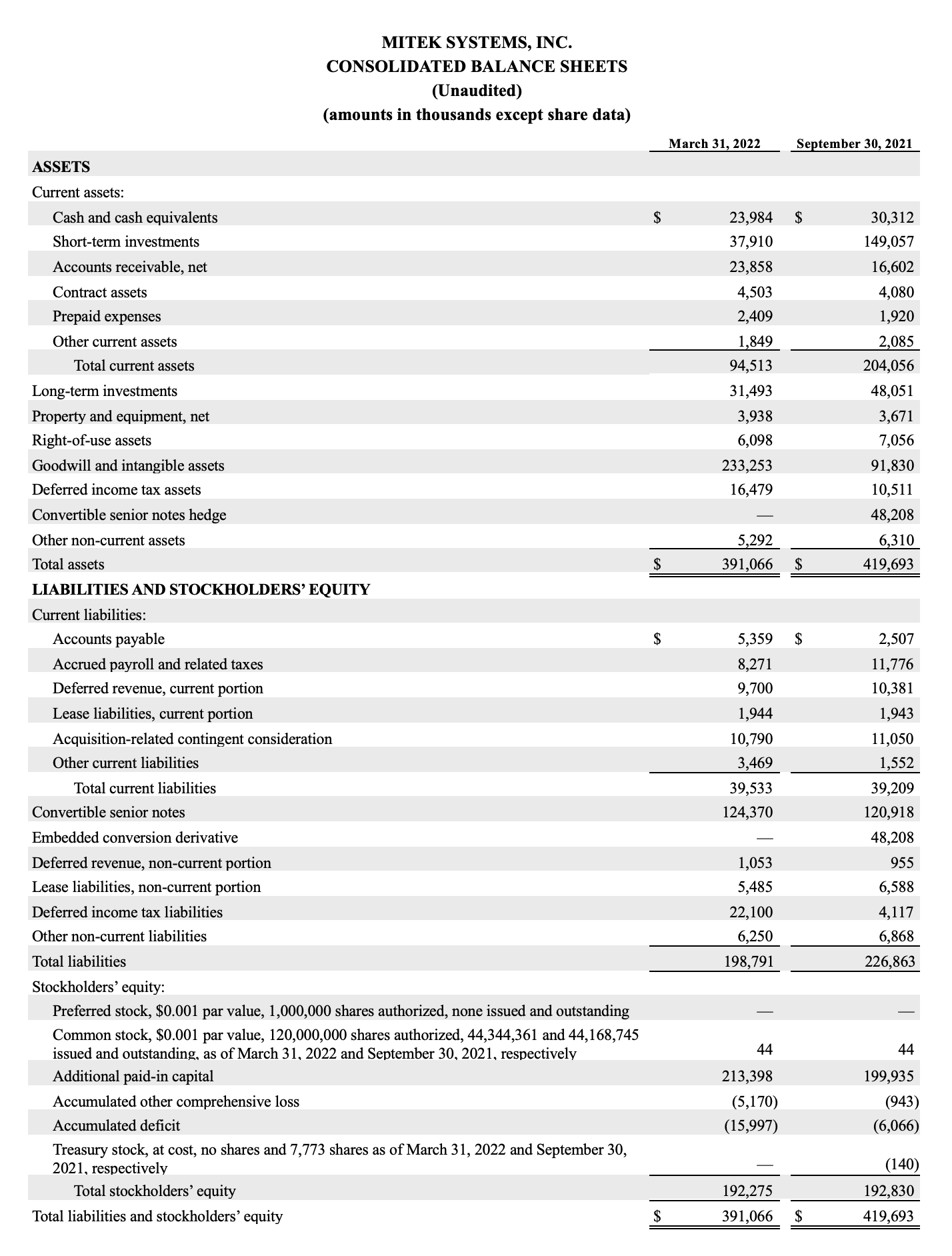

- Total cash and investments were $93.4 million at the end of the quarter.

“Digital identity verification has moved beyond just being an enabler of digital commerce, it now serves as an integral element of most organizations’ technology stack,” said CEO Max Carnecchia. “We believe the next decade of fraud prevention will be defined by an organization’s approach to the lifecycle of identity and access management capabilities. With our acquisition of HooYu, Mitek is significantly expanding access to these services through our low code no code orchestration platform.”

“Our acquisition of HooYu continues to expand our digital identity offering allowing for a more seamless and complete customer identification experience at scale while also significantly bolstering our fraud prevention capabilities,” added CFO Frank Teruel. “We are excited about the opportunity to bring these capabilities to more use cases and industries helping them increase customer acceptance while reducing fraud and operational costs.”

Conference call information

Mitek management will host a conference call and live webcast for analysts and investors today at 1:30 p.m. Pacific Time (4:30 p.m. Eastern Time) to discuss the Company’s financial results.

To access the live call, dial 888-204-4368 (US and Canada) or +1 323-994-2093 (International) and give the participant passcode 5221376.

A live and archived webcast of the conference call will be accessible on the Investor Relations section of the Company’s website at www.miteksystems.com. In addition, a phone replay will be available approximately two hours following the end of the call, and it will remain available for one week. To access the call replay dial-in information, please click here.

About Mitek

Mitek (NASDAQ: MITK) is a global leader in digital identity and fraud prevention solutions built on the latest advancements in computer vision and artificial intelligence. Mitek’s digital identity solutions enable organizations to verify an individual’s identity during digital transactions to reduce risk and meet regulatory requirements, while increasing revenue from digital channels. More than 7,500 organizations use Mitek to enable trust and convenience for mobile check deposit, new account opening, and more. Mitek is based in San Diego, Calif., with offices across the U.S. and Europe. Learn more at www.miteksystems.com. [(MITK-F)]

Follow Mitek on LinkedIn, Twitter and YouTube, and read Mitek’s latest blog posts here.

Notice regarding forward-looking statements

Statements contained in this news release relating to the Company or its management’s intentions, hopes, beliefs, expectations or predictions of the future, including, but not limited to, statements relating to the Company’s long-term prospects and market opportunities are forward-looking statements. Such forward-looking statements are subject to a number of risks and uncertainties, including, but not limited to, risks related to the Company’s ability to withstand negative conditions in the global economy, the extent to which the COVID-19 outbreak and measures taken in response thereto impact its business, results of operations and financial condition, a lack of demand for or market acceptance of the Company’s products, the impact of the Company’s acquisition of HooYu Ltd. including any operational or cultural difficulties associated with the integration of the businesses of Mitek and HooYu, the Company’s ability to continue to develop, produce and introduce innovative new products in a timely manner or the outcome of any pending or threatened litigation and the timing of the implementation and launch of the Company’s products by the Company’s signed customers.

Additional risks and uncertainties faced by the Company are contained from time to time in the Company’s filings with the U.S. Securities and Exchange Commission (SEC), including, but not limited to, the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2021, as filed with the SEC on December 13, 2021 and its quarterly reports on Form 10-Q and current reports on Form 8-K, which you may obtain for free on the SEC’s website at www.sec.gov. Collectively, these risks and uncertainties could cause the Company’s actual results to differ materially from those projected in its forward-looking statements and you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company disclaims any intention or obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Investor Contact:

Todd Kehrli or Jim Byers

MKR Group, Inc.

mitk@mkr-group.com

Note regarding use of non-gaap financial measures

This news release contains non-U.S. generally accepted accounting principles (“GAAP”) financial measures for non-GAAP net income and non-GAAP net income per share that exclude stock compensation expenses, intellectual property litigation costs, acquisition-related costs and expenses, amortization of debt discount and issuance costs, income tax effect of pre-tax adjustments, and the cash tax difference. These financial measures are not calculated in accordance with GAAP and are not based on any comprehensive set of accounting rules or principles. In evaluating the Company’s performance, management uses certain non-GAAP financial measures to supplement financial statements prepared under GAAP. Management believes these non-GAAP financial measures provide a useful measure of the Company’s operating results, a meaningful comparison with historical results and with the results of other companies, and insight into the Company’s ongoing operating performance. Further, management and the Board of Directors of the Company utilize these non-GAAP financial measures to gain a better understanding of the Company’s comparative operating performance from period-to-period and as a basis for planning and forecasting future periods. Management believes these non-GAAP financial measures, when read in conjunction with the Company’s GAAP financial statements, are useful to investors because they provide a basis for meaningful period-to-period comparisons of the Company’s ongoing operating results, including results of operations against investor and analyst financial models, which helps identify trends in the Company’s underlying business and provides a better understanding of how management plans and measures the Company’s underlying business.