Digital transactions have been a part of my weekly routine for a long time. The freedom of transacting where and whenever I want was fantastic. Fast forward six months to a world governed by a global pandemic, and that freedom is now a necessity. From online groceries and banking to consults with the doctor and, of course, happy hours with my friends, it’s all now the 2020 way of life.

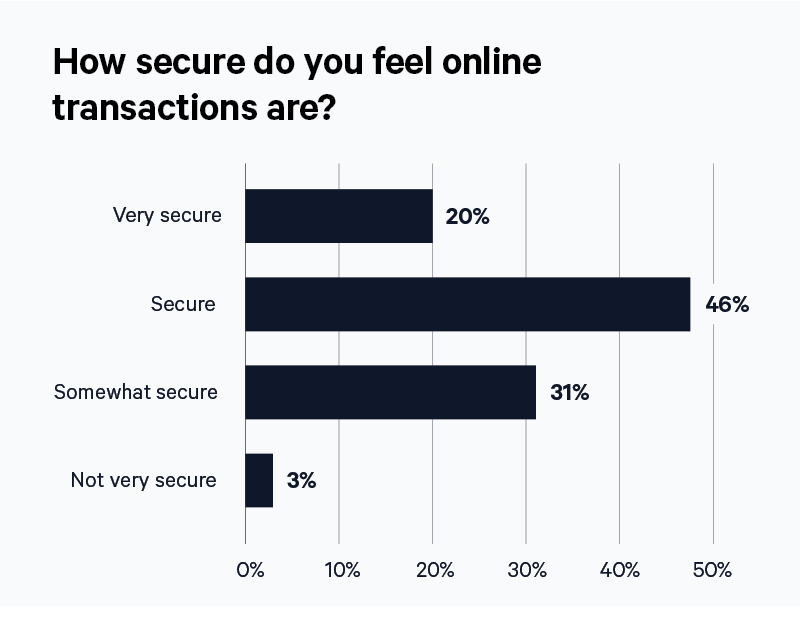

But how secure do we feel about today’s wholesale move to digital commerce? According to a new survey by Mitek partner Lightico, only 66% of survey respondents say they believe their online transactions are secure or very secure, leaving 34% anxious. That’s less than ideal.

From my years working in technology, I know that online commerce can be complicated. For many of us it has been a lifesaver, but the increase in digital transactions has also increased the opportunity for fraudsters and online identity fraud.

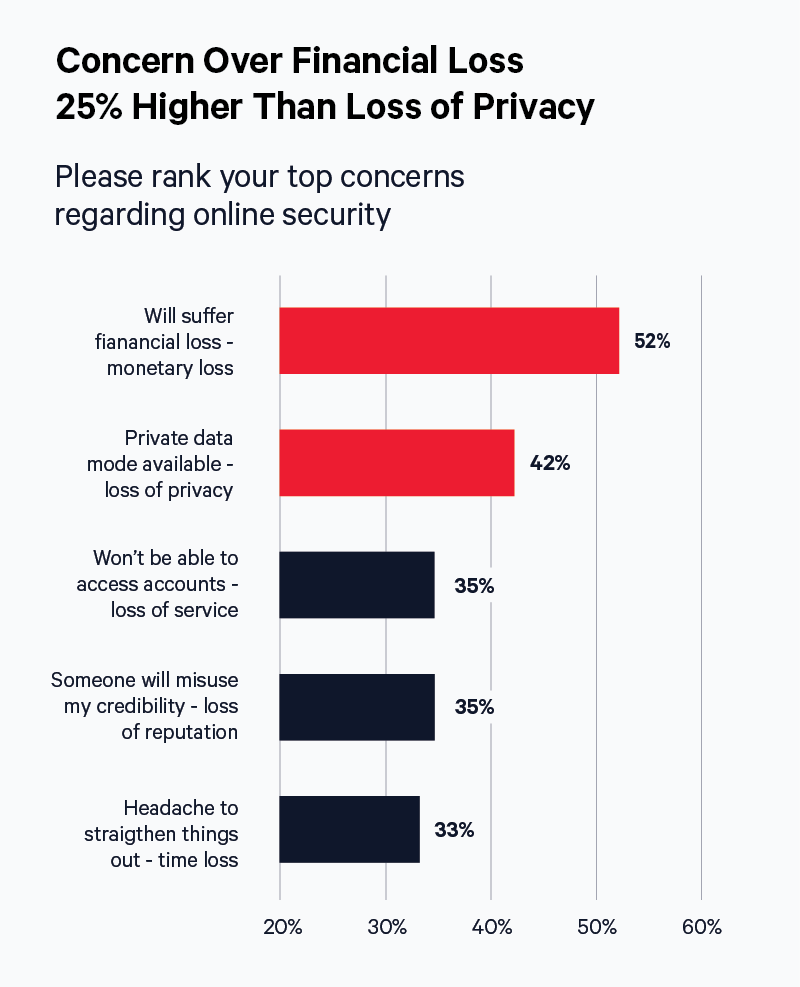

That’s one reason I – and more than 30% of survey respondents – rate online safety and privacy as a priority. We question how companies are protecting us when we decide who to do business with online.

New research from Gartner states, “The rise in bad actors threatens to poison digital business,” summarizing its June 2020 report on trust and safety online. “Security and risk management leaders responsible for identity and access management and fraud detection must expand their vision beyond loss prevention and focus on enhancing the customer journey while deterring the dishonest actor.”*

Gartner laid out three key principles for increasing trust and safety on the internet:*

Being able to trust customers — It is a tenet of consumer identification and access management systems and also online fraud applications that their primary purpose is to reduce risk by establishing trust in the identity assertion by the customer.

Engendering customer trust in the organization — In a reflective point to above, the customer must be able to trust the organization. This extends beyond just corporate identity and into trust in its business processes and customer service ethos.

Enhancing customer safety online and in the physical world and making them feel safe — Customers need to feel secure that in the online world their business will be transacted reliability and securely. Where a transaction extends into the physical world, for example a sharing economy transaction, the consumer needs to feel confident that the other party will behave ethically and honestly. In addition, the service provider needs to feel confident that the consumer will not abuse the provided service.

Our identity verification technology allows an enterprise to verify a user’s identity during a digital transaction, critical for financial institutions, marketplaces and other businesses operating in highly regulated markets.

This year Mitek and Digidentity worked together to ensure processing speeds of up to 400 applicants per minute to accommodate the growing need for UK nationals and residents to apply for government services, including Universal Credit, during the pandemic.

We have also worked with companies such as Varo and Anna Money to help them create engaging user experiences that consumers can trust, the first step toward building ongoing relationships.

“It all comes down to how much can I as a consumer trust the entity I’m engaging with on the other end of a transaction.” says Kathleen Peters, vice president and head of Fraud and Identity Business at Experian.

Finding this balance of security and customer experience is good business. In fact, returning to Gartner, the research company estimates that, “by 2022, digital businesses with a smooth customer journey during identity corroboration will earn 10% more revenue than comparable businesses with an unnecessarily frictional customer journey. And by 2023, customer assurance will be so integral to a company’s success that 30% of banks and digital commerce businesses will have dedicated trust and safety teams to protect the integrity of all online customer/brand interactions, up from less than 5% today.”*

Mitek will stay at the forefront of these evolving trends. Because protecting your customers’ financial and online transactions is our company’s mission

*Gartner, Create Trust and Safety on the Internet, June 2020