San Diego, California, August 7, 2025 — Mitek Systems, Inc. (NASDAQ: MITK, www.miteksystems.com, “Mitek” or the “Company”), a global leader in digital identity verification and fraud prevention, today reported financial results for its third quarter ended June 30, 2025 and raised the midpoint of its revenue and adjusted EBITDA margin guidance ranges for its fiscal 2025 full year ending Sept. 30, 2025 (“fiscal 2025”).

“Mitek delivered a solid third quarter, with SaaS revenue growth accelerating to 23% year over year, clear evidence of growing demand for our identity and fraud solutions,” said Ed West, chief executive officer of Mitek Systems. “Our core Deposits software products continue to provide stability on a longer term trended basis, supported by resilient transaction volumes and strong free cash flow generation. We’re executing on what we said we would do: shifting to SaaS, streamlining our operations internally, and aligning our product investments and go-to-market strategy around a unified, integrated platform. While there’s still more to do, we’re making steady progress and laying the groundwork for durable, profitable growth.”

Fiscal 2025 Third Quarter Financial Highlights

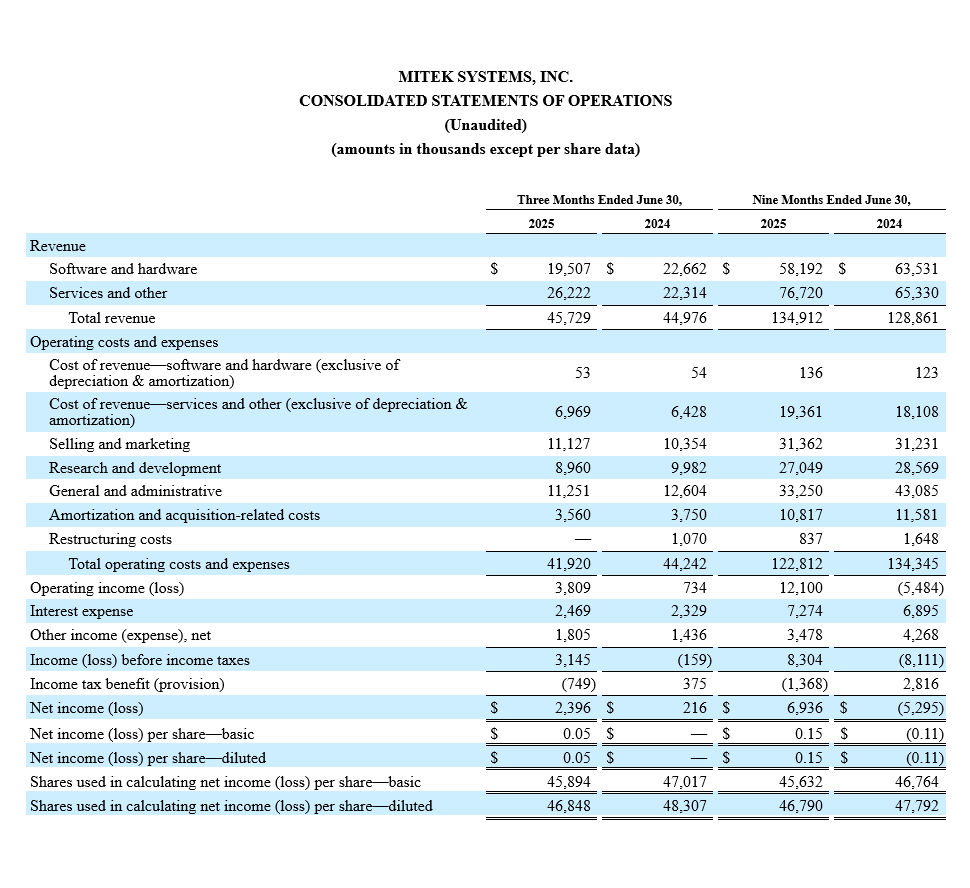

GAAP

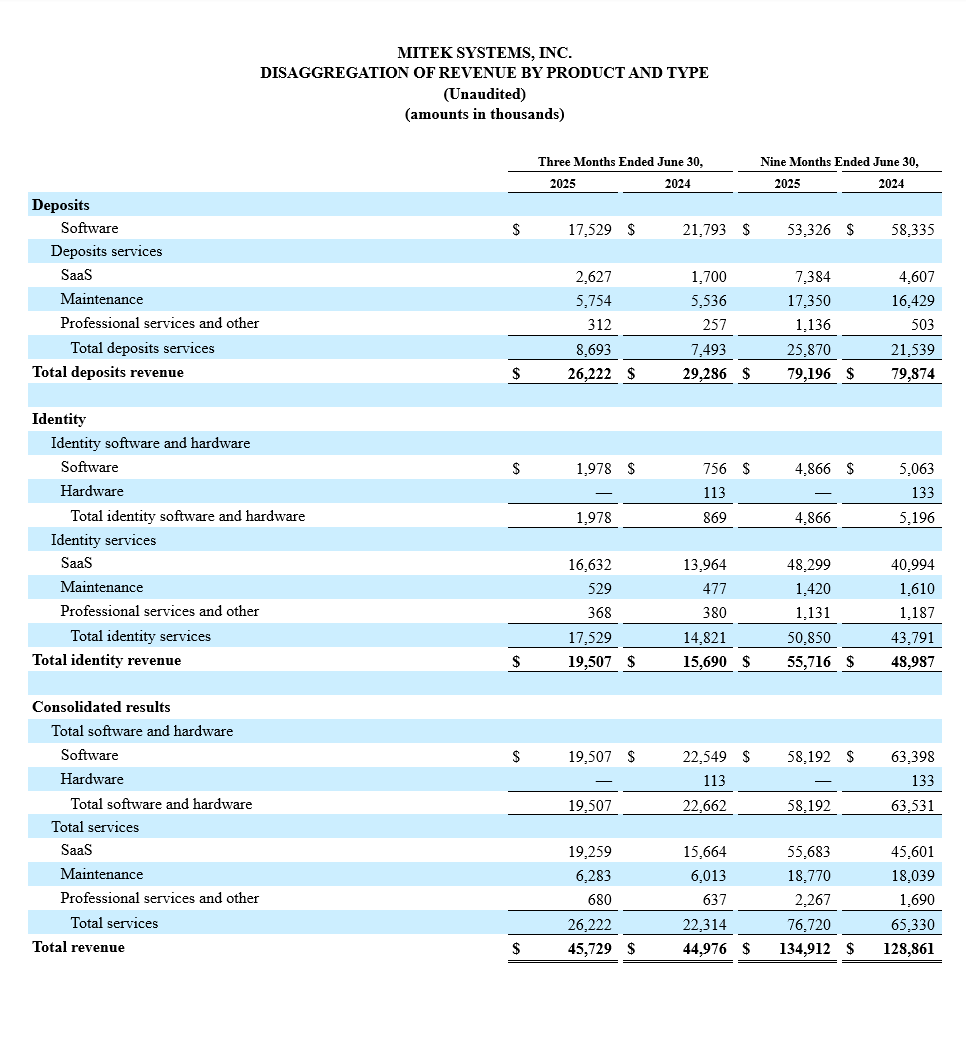

- Total revenue of $45.7 million was a 2% increase year-over-year, compared to $45.0 million a year ago.

- SaaS revenue of $19.3 million was a 23% increase year-over-year, compared to $15.7 million a year ago.

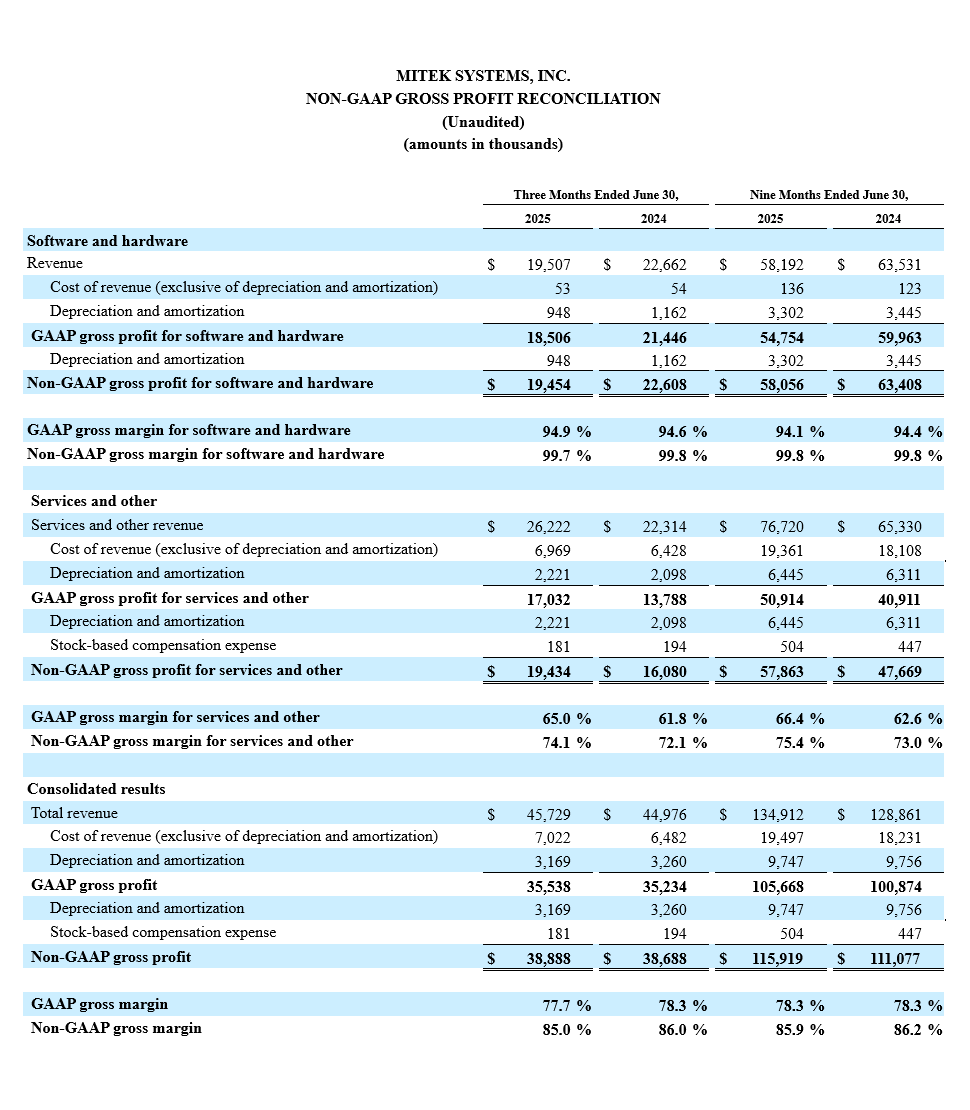

- Gross profit of $35.5 million was a 1% increase year-over-year, compared to $35.2 million a year ago.

- GAAP gross profit margin was 77.7%, compared to 78.3% a year ago.

- GAAP net income was $2.4 million, compared to GAAP net income of $0.2 million a year ago.

- GAAP net income per diluted share was $0.05, compared to $0.00 a year ago.

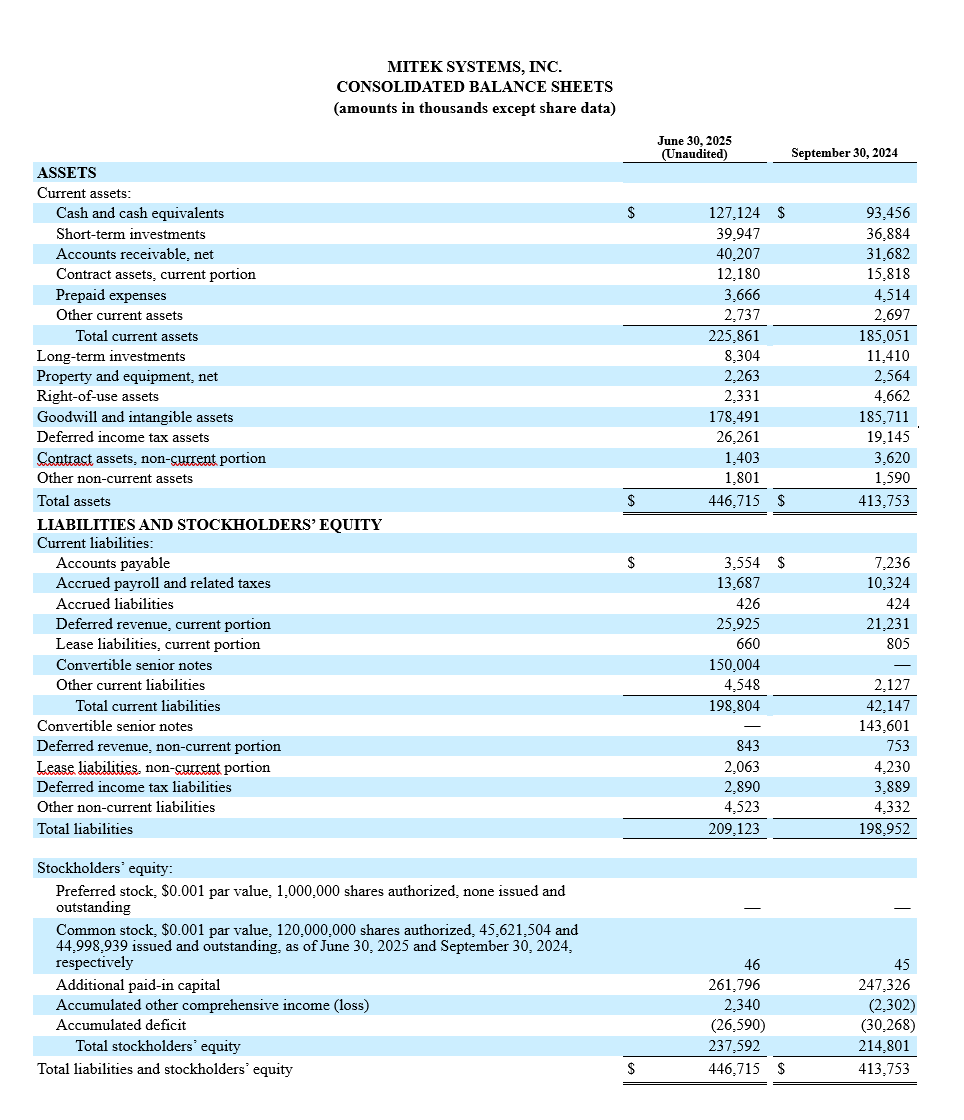

- Total cash and investments was $175.4 million at June 30, 2025, an increase of $33.6 million from $141.8 million at September 30, 2024.

Non-GAAP

- Non-GAAP gross profit of $38.9 million was a 1% increase year-over-year, compared to $38.7 million a year ago.

- Non-GAAP gross profit margin was 85.0%, compared to 86.0% a year ago.

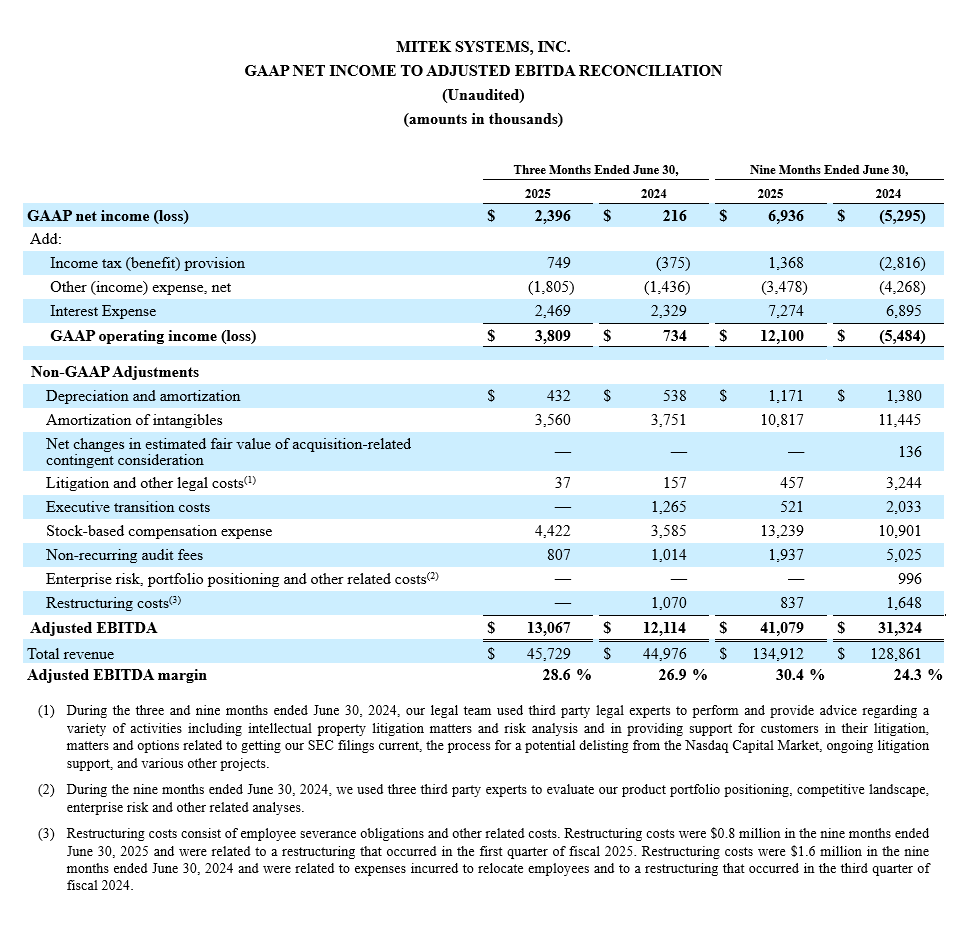

- Adjusted EBITDA was $13.1 million, compared to $12.1 million a year ago.

- Adjusted EBITDA margin was 28.6%, compared to 26.9% a year ago.

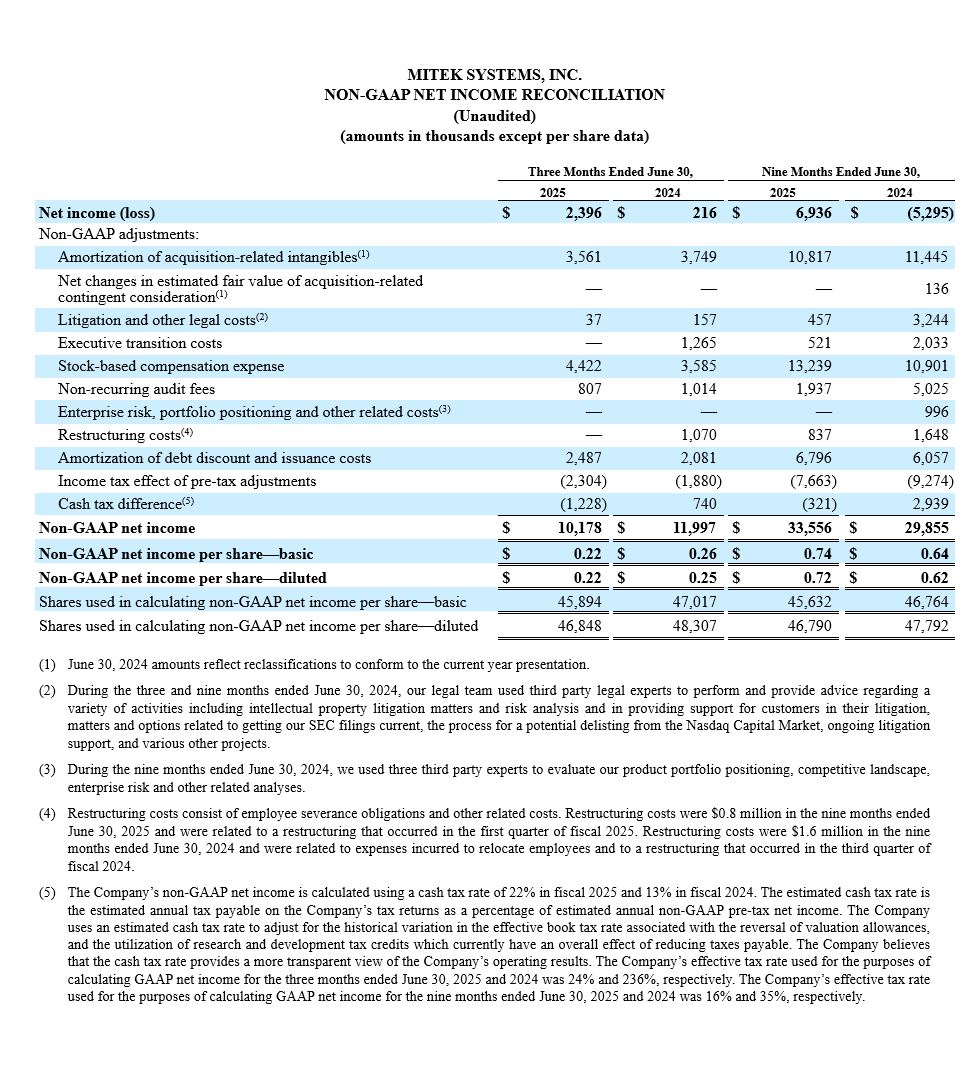

- Non-GAAP net income was $10.2 million, compared to $12.0 million a year ago.

- Non-GAAP net income per diluted share was $0.22, compared to $0.25 a year ago.

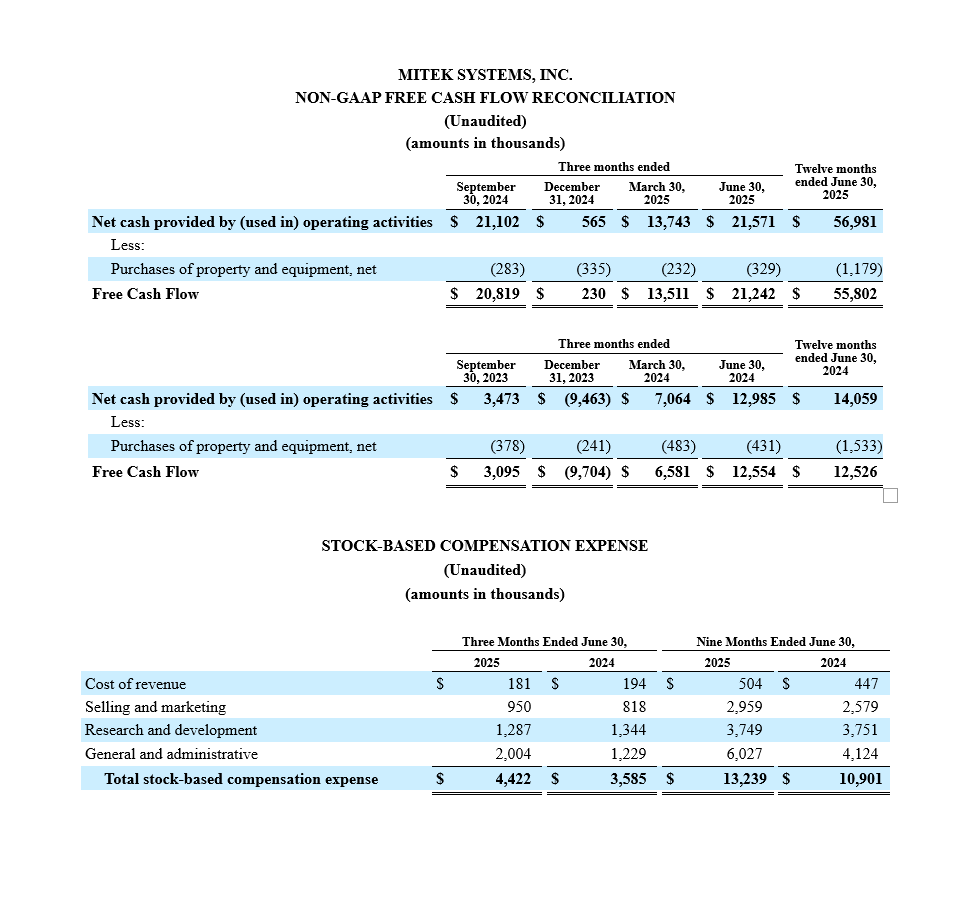

- Free cash flow was $35.0 million for the nine months ended June 30, 2025, compared to $9.4 million for the corresponding period a year ago, and was $55.8 million for the twelve months ended June 30, 2025, compared to $12.5 million for the corresponding period a year ago.

Fiscal 2025 Full Year Guidance

Mitek is updating its guidance for its fiscal 2025 year ending Sept. 30, 2025, as follows:

- Mitek is tightening its full-year fiscal 2025 revenue guidance to a range of $174 million to $177 million, compared to a prior range of $170 million to $180 million. This implies fiscal fourth quarter revenue of $39 million to $42 million.

- Mitek is tightening its full-year fiscal 2025 adjusted EBITDA margin guidance to 28%-29%, compared to a prior range of 26%-29%.

Conference Call Information

Mitek management will host a conference call and live webcast for analysts and investors today at 2 p.m. PT (5 p.m. ET) to discuss the Company’s financial results for its fiscal 2025 third quarter. To join the webcast, visit our investor relations website at https://investors.miteksystems.com. Participants may also dial +1 800-717-1738 (US and Canada) or +1 646-307-1865 (International) to access the call. A phone replay will be available approximately two hours after the call ends and will remain available for one week by dialing +1 844-512-2921 (US and Canada) or +1 412-317-6671 (International) and entering the passcode 1154629. An archived webcast will also be available for one year on Mitek’s Investor Relations website.

About Mitek Systems, Inc.

Mitek Systems protects what’s real across digital interactions in a world of evolving threats. Mitek helps businesses verify identities, prevent fraud before it happens, and deliver secure, seamless digital experiences in the face of rapidly advancing AI-generated threats. From account opening to authentication and deposit, Mitek’s technology safeguards critical digital interactions. More than 7,000 organizations rely on Mitek to protect their most important customer connections and stay ahead of emerging risks. Learn more at www.miteksystems.com. [(MITK-F)]

Follow Mitek on LinkedIn and YouTube, and read Mitek’s latest blog posts here.

Notice Regarding Forward-Looking Statements

Statements contained in this news release relating to the Company or its management’s intentions, hopes, beliefs, expectations or predictions of the future, including, but not limited to, statements relating to the Company’s fiscal 2025 guidance, are forward-looking statements. Such forward-looking statements are subject to a number of risks and uncertainties, including, but not limited to, risks related to the Company’s ability to withstand negative conditions in the global economy, a lack of demand for or market acceptance of the Company’s products, the Company’s ability to continue to develop, produce and introduce innovative new products in a timely manner, the Company’s ability to capitalize on a growing market, quarterly variations in revenue, the profitability of certain sectors of the Company, the performance of the Company’s growth initiatives, the outcome of any pending or threatened litigation or investigation, and the timing of the implementation and launch of the Company’s products by the Company’s signed customers.

Additional risks and uncertainties faced by the Company are contained from time to time in the Company’s filings with the U.S. Securities and Exchange Commission (SEC), including, but not limited to, the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2024, as filed with the SEC on December 16, 2024 and its quarterly reports on Form 10-Q and current reports on Form 8-K, which you may obtain for free on the SEC’s website at www.sec.gov. Collectively, these risks and uncertainties could cause the Company’s actual results to differ materially from those projected in its forward-looking statements and you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company disclaims any intention or obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Investor contacts

Ryan Flanagan

ICR for Mitek Systems

IR@miteksystems.com

Michael Holder

VP, Finance and Investor Relations

mholder@miteksystems.com

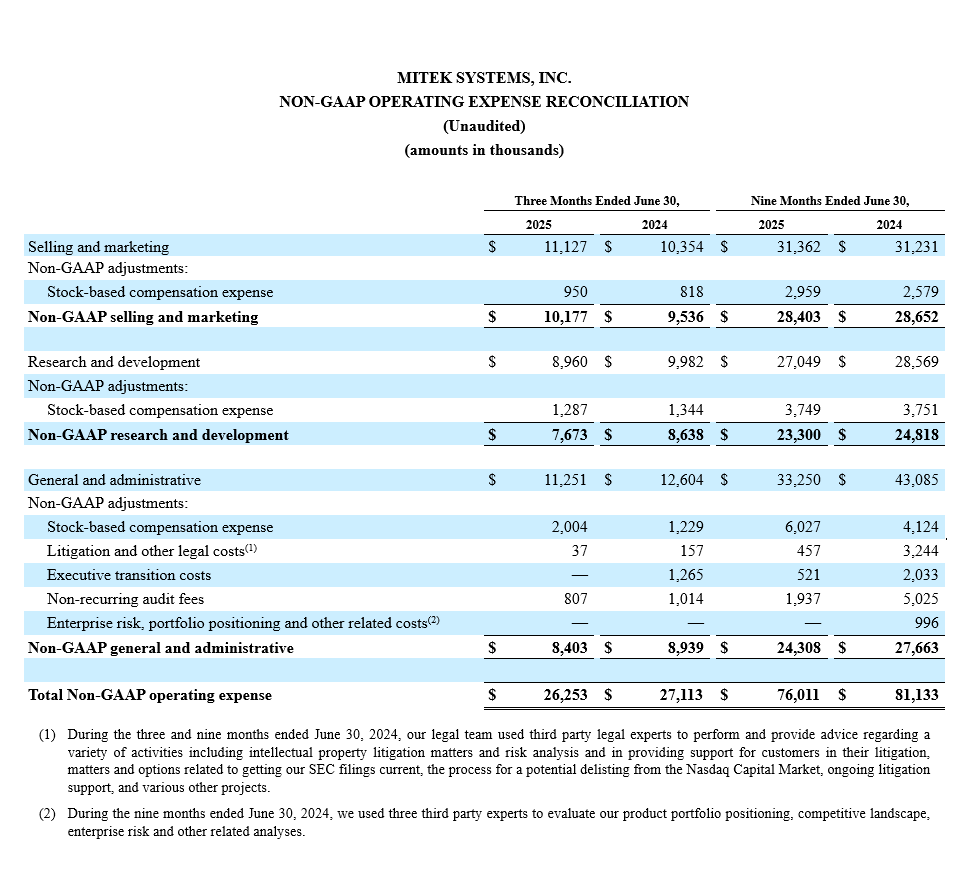

Note Regarding Use of Non-GAAP Financial Measures

This news release contains non-U.S. generally accepted accounting principles (“GAAP”) financial measures for non-GAAP gross profit, non-GAAP cost of revenue, non-GAAP gross margin, non-GAAP net income, non-GAAP net income per share, non-GAAP operating income, non-GAAP operating margin, adjusted EBITDA, and adjusted EBITDA margin and non-GAAP operating expense that exclude amortization of acquisition-related intangibles, net changes in estimated fair value of acquisition-related contingent consideration, litigation and other legal costs, executive transition costs, stock-based compensation expense, non-recurring audit fees, enterprise risk, portfolio positioning and other related costs, restructuring costs, and amortization of debt discount and issuance costs. These financial measures are not calculated in accordance with GAAP and are not based on any comprehensive set of accounting rules or principles. In evaluating the Company’s performance, management uses certain non-GAAP financial measures to supplement financial statements prepared under GAAP. Management believes these non-GAAP financial measures provide a useful measure of the Company’s operating results, a meaningful comparison with historical results and with the results of other companies, and insight into the Company’s ongoing operating performance. Further, management and the Board of Directors of the Company utilize these non-GAAP financial measures to gain a better understanding of the Company’s comparative operating performance from period-to-period and as a basis for planning and forecasting future periods. Management believes these non-GAAP financial measures, when read in conjunction with the Company’s GAAP financial statements, are useful to investors because they provide a basis for meaningful period-to-period comparisons of the Company’s ongoing operating results, including results of operations against investor and analyst financial models, which helps identify trends in the Company’s underlying business and provides a better understanding of how management plans and measures the Company’s underlying business.

The Company has not provided a reconciliation of its forward outlook for non-GAAP adjusted EBITDA margin with its forward-looking GAAP net income margin in reliance on the unreasonable efforts exception provided under Item 10(e)(1)(i)(B) of Regulation S-K. The Company is unable, without unreasonable efforts, to quantify share-based compensation expense, which is excluded from our non-GAAP adjusted EBITDA margin, as it requires additional inputs such as the number of shares granted and market prices that are not ascertainable due to the volatility of the Company’s share price. Additionally, a significant portion of the Company’s operations are in foreign countries and the transactional currencies are primarily Euros and British pound sterling and the Company is not able to predict fluctuations in those currencies without unreasonable efforts. The Company expects these items may have a potentially significant impact on future GAAP financial results.

We define free cash flow as net cash provided by operating activities, less cash used for purchases of property and equipment. We define free cash flow margin as free cash flow as a percentage of revenue. In addition to the reasons stated above, we believe that free cash flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash in excess of our capital investments in property and equipment in order to enhance the strength of our balance sheet and further invest in our business and potential strategic initiatives. A limitation of the utility of free cash flow as a measure of our liquidity is that it does not represent the total increase or decrease in our cash balance for the period. We use free cash flow in conjunction with traditional U.S. GAAP measures as part of our overall assessment of our liquidity, including the preparation of our annual operating budget and quarterly forecasts and to evaluate the effectiveness of our business strategies. There are a number of limitations related to the use of free cash flow as compared to net cash provided by operating activities, including that free cash flow includes capital expenditures, the benefits of which are realized in periods subsequent to those when expenditures are made. We may refer to certain financial metrics on a Last Twelve Months (“LTM”) basis. LTM figures represent the sum of the most recently reported four fiscal quarters and are used to provide a view of the company's financial performance over the past year.

Mitek encourages investors to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, which it includes in press releases announcing quarterly financial results, including this press release, and not to rely on any single financial measure to evaluate Mitek’s business.