Lending

Approve more loans while preventing fraud with digital ID verification & biometrics

Scale loan origination with a fast and smooth digital identity verification process that balances customer experience with security.

Balance customer experience and security in your digital loan origination

Whether it's a personal loan, auto loan, or refinancing application, digital identity verification solutions ensure the safety and security of loan origination and approve more customers faster in a frictionless and compliant way.

Trust precedes transactions.

Developing and maintaining consumer trust requires creating humancentric experiences backed by a secure and simple solution

Identity verification is essential for every customer and every journey.

Ensure regulatory compliance at all times

Meet any risk profile on your KYC workflows with the identity services you need.

Stay ahead of fraudsters

Better detect attempted impersonation fraud across any customer touchpoint

Optimize user journeys

Maximize onboarding success rates with minimal friction

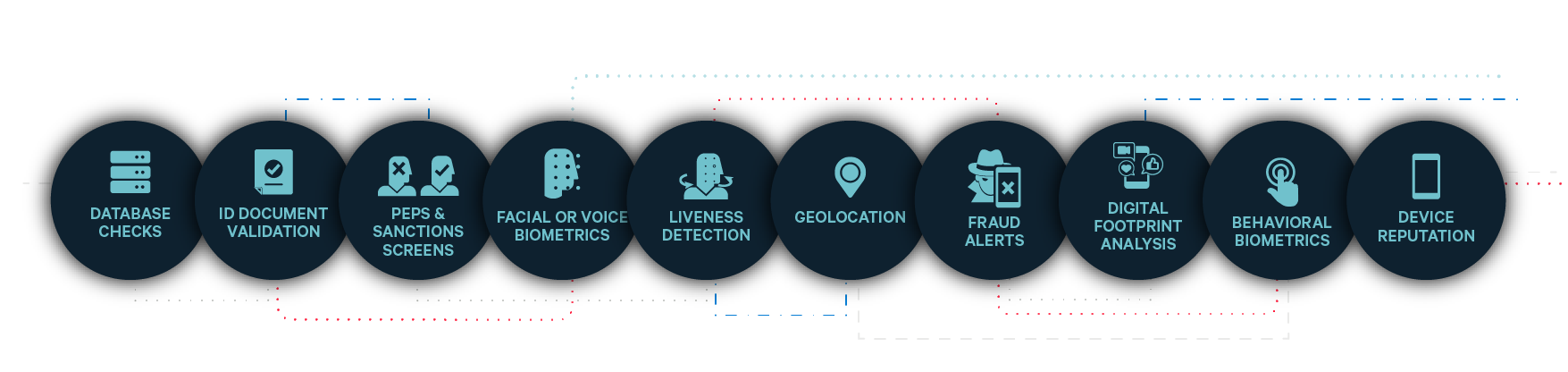

Strengthen trust and convenience using multiple layers of verification signals

Achieve a dynamic, risk-based approach to verifying digital identities by layering identity signals in real time. Customize the identity verification requirements of each journey to create the perfect balance between fraud prevention and the optimal customer experience. Identity verification exactly the way you need it.

Identity solutions for financial services

“In Mitek, we found a partner who could scale with us and support the volume of transactions we process daily.”

Nash Ali

Head of Risk & Payments at MoneyGram